Why this Article (Almost Definitely) Applies to You

If you’re a business leader, then you – and your business – are probably very early in your AI adoption journey. You are not alone.

Despite all of the hype around generative AI, real adoption has barely begun. It’s difficult to find reliable data for gen-AI specifically, but if we consider gen-AI as a share of knowledge work as a proxy, then real AI adoption is probably still under 1% (sources and methodology for this figure are provided in the footer).

So, unless you’re in a tiny minority of business leaders, you’re probably wondering;

- how important is AI for my particular business;

- is AI production ready for any of my particular use cases; and

- when should I start prioritising AI adoption?

This article seeks to help you answer those questions. Spoiler alert; for you, the answers are probably: 1) very; 2) yes; and 3) now.

The central thesis of the Proof to Production blog is that the competitive battle will be won or lost on the journey to AGI, not when it arrives. But, you will only know in retrospect whether being a first mover – or at least a fast follower – was indeed critical to your competitive survival.

So, how to test this thesis ahead of time? Fortunately, there is a wonderful piece of pre-AI old school tech which allows us to peer into the future: the humble spreadsheet.

To model how the AI Transition could play out, this article is based around a financial model that simulates the impact of AI adoption on two companies in the same industry over a three year period from 2025 to 2027. One is a first mover, innovating at AI’s ‘jagged frontier’ by implementing the technology as soon as economically viable capabilities emerge. The other is a slow follower that initially pursues growth by doubling down on its legacy business model, only starting its AI transformation when it becomes a competitive necessity.

You can download a copy of the model here and run the simulation yourself, using your own assumptions about the readiness of AI to augment or replace different business functions, the future rate of improvement in the capabilities and cost of AI, and the likely rate of AI adoption in the coming years.

But how relevant is this type of modelling exercise for your own business? Some industry sectors will be more affected by AI than others. If you’re a builder, a plumber or an electrician, you might have less to worry about in the short term.

But, if your company has any of the following characteristics, your business is probably more vulnerable:

- Knowledge work (i.e. labour performed at a computer) makes up a significant proportion of your cost structure.

- Successfully leveraging the value of data is critical to various functions within your business.

- You are in a sector with a constrained pool of customers and budgets for your particular product or service.

- Your business is in a competitive, mature market with relatively tight and consistent margins.

If all of these apply to your business, then definitely read on.

Point three actually applies to most businesses. For example, in the residential mortgage industry – the sector we use in our financial model – there are only a certain number of mortgages purchased each year – around one million in the UK. In markets with restricted demand, first movers who are able to acquire more customers at a lower cost through AI-enablement of their sales and marketing processes, will do so at the expense of slower adopters.

By playing with the financial model yourself, you will realise that, even with small changes in key metrics that compound over time, the first mover rapidly builds up a significant advantage over the slow follower. As the first mover accumulates more resources for ongoing innovation, expansion and pricing power, this advantage becomes increasingly unassailable.

This has serious implications if point four also applies to your business. Average profit margins for all UK non-financial businesses have stayed between 10-11% over the last 10 years. The industry that I work in, IT services, generates average net margins of less than 10% in most years, while the UK service industry as a whole averaged profit margins between 12-14% over the last decade. Put simply, in businesses like these, if you stand still, while your competition is able to reduce costs by just 10-15% and pass those savings onto customers (i.e. your customers), then your business is no longer financially viable.

(A note to the reader: Hands-up, this is a long article! But if the very survival of your business might be on the line, does 15 minutes of your time seem reasonable? Often, the best way to understand something is through a story. And that’s what this is; a story of two companies – that could be your story too in the coming years. If, like me, you need to see the numbers with your own eyes, then play with the spreadsheet and try to imagine similarities with your own business. Or better still, create your own version and model your own possible futures for the AI Transition. My hope is that this hands-on participation, and this story, will help you really “feel the AI”.)

About the “RLI in Practice Simulation”

The downloadable financial model starts with both companies being in the same financial position in 2024 and then allows you to adjust key financial metrics and cost ratios to assess the impact of implementing AI in various functions of each business at different rates and levels of effectiveness in the coming years.

Mortgage brokers have been selected for this modelling exercise for the following reasons:

- The process of buying a mortgage is something that many readers may be familiar with.

- The majority of job functions within a mortgage broker – being primarily sales, marketing, administrative and customer service related – are particularly well suited to augmentation or replacement by AI.

- The mortgage broker industry is relatively mature and competitive, with fairly tight margins, making these companies particularly vulnerable to technological disruptions that materially alter their unit economics.

- The mortgage industry is a good illustration of the concept of constrained demand that is a reality for most businesses (i.e. a fundamentally limited customer-base and addressable market value).

This is a companion article to Proof to Production’s inaugural essay, The RLI Revolution: Why Only AI-First Companies Will Survive the Transition, that describes a framework for companies to compete successfully as the ‘AI Transition’ unfolds, and the implications of failing to do so. If you want to dive straight into this article without reading it, here are some of the key concepts it covered:

- “Replacement Level Intelligence” (RLI) refers to the threshold when a particular task or subtask performed by a knowledge worker can be executed by AI at a level of capability and cost sufficient to replace the human in performing that specific function.

- The ‘jagged frontier’ of AI is ever changing, with new capabilities at ever lower cost creating an environment where opportunities for competitive advantage continually emerge.

- ‘AI-first’ companies that are able to move quickly to implement RLI as the jagged frontier advances will outperform – and in some cases even replace – slower-moving competitors.

An RLI Story

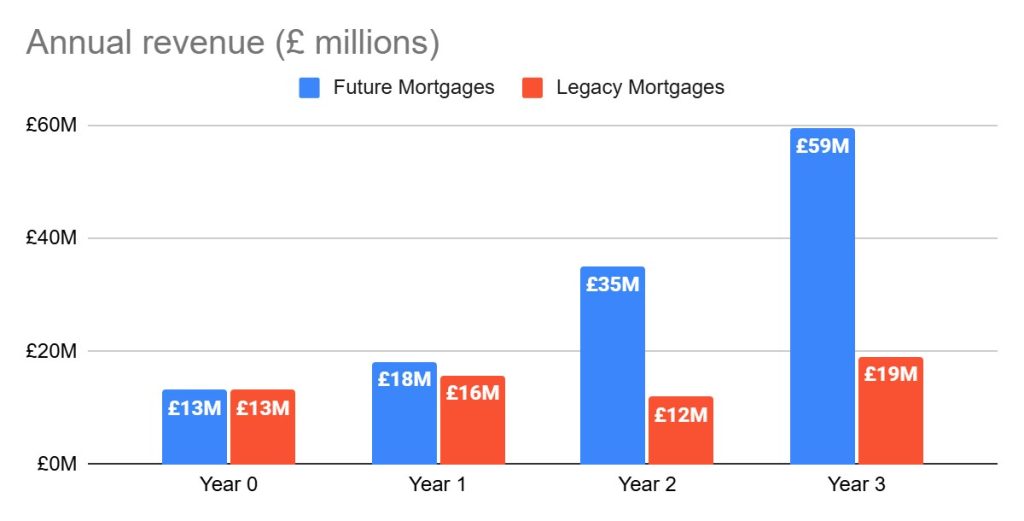

Let’s begin by introducing our two competing companies. Both are mid-size mortgage brokers with 170 staff and a turnover of £13M. When our story starts, in late 2024, the two companies are in the same operational and financial state, both with little or no AI adoption. The only difference between them is the vision and mindset of their new CEOs.

The First Mover

The founder of our first company – Future Mortgages – had a lights-on moment when he read The RLI Revolution on the Proof to Production blog (😉). He has moved to a chairman role and taken on a bright, tech-savvy young CEO, Sonny Nadella, headhunted (with generous performance-based share options) from a successful commercial career in the SaaS industry.

He worked closely with the Chief Technology Officer (CTO) in his previous role and saw the transformative effects of integrating AI into their product offering. As the Chief Commercial Officer, he also spearheaded early AI implementation efforts in his department and witnessed the resulting sales productivity and CX gains with his own eyes. A true believer in the transformative potential of the technology, he can see opportunities to use AI in almost every element of Future’s business. He has the full support of the board and shareholders to embark on an ambitious growth program by turning Future into an AI-first company.

Sonny’s hobbies are cooking and tinkering with electronic music composition (not particularly well), but between listening to podcasts about AI and obsessively following developments at AI’s jagged frontier, he doesn’t have much time for the latter these days.

The Slow Follower

The other company – Legacy Mortgages – is also run by a new CEO, Dave Collins, recently promoted up through the ranks off the back of years of graft and steady growth. One of Legacy’s early hires, he has spent his entire career in the industry, building the team to 100 mortgage advisors over his 15 years as Sales Director.

He’s hard working, practical and process-led and he knows how this industry works like the back of his hand. He’s seen small changes over the years, but the formula has basically stayed the same. Buy leads. Sell. Repeat. That’s how he got to 100 advisors and that’s how he’s going to get to 200. He’s been skeptical about the hype around AI since asking ChatGPT how many Rs there are in strawberry back in early 2024 (not two!). He sees it as a distraction – at least at its “current” level of capability. Besides, Legacy isn’t a technology company. It’s a sales company. AI is something to worry about later – when it’s ready.

Dave is also a tinkerer. In his case it’s classic cars – nothing too expensive, but spending time in his garage taking them apart and putting them back together again, with the football on the radio, that’s Dave’s happy place.

The AI Transition Changes Everything

The following scenario (my personal take on the financial model) explains in detail how the fortunes of the two companies evolve year-over-year and how the first mover implements AI to win the competitive battle. The graphs below summarise the financial outcome. You can download the financial model here to generate your own graphs based on your version of the simulation.

2024 – Before The Transition

Our two companies have the same business model on day one:

- Their primary source of new customers is the leads they purchase from mortgage price comparison websites. There are two classes of leads available for purchase: ‘exclusive’ which are sold to a single mortgage broker at a cost £30; and ‘non-exclusive’, which cost £10 and are sold to multiple mortgage brokers. Exclusive leads have a higher close rate (1 in 8), giving a lead cost per acquisition of £240.

- With time for deal follow-up and admin tasks, mortgage advisors can work about 4 leads per day effectively, so it makes more sense financially, once you’ve baked in the cost of advisor salaries, to pay the higher cost for exclusive leads. Additionally, if you want to attract and retain the best advisors, you need to give them the best leads, so both companies only purchase exclusive leads.

- The average mortgage is £200k, on which the company earns a 0.375% commission from the lender. They charge buyers an arrangement fee equivalent to half of the lender commission, although they forgo this fee in half of cases to incentivise customers to commit to them when they’re up against an offer from a competing mortgage broker. For 20% of the deals they close, they also generate additional income by selling mortgage insurance. All in, the gross value of the average deal is just over £1k.

- Each company has 100 advisors. They are paid 20% of the total revenue per sale over-and-above their £30k basic salary, with a further 2% being paid in bonuses to the Sales Director and other executives. With commissions, the average advisor’s total annual compensation is £56k – around the industry average.

- To support their 100 advisors, the companies also employ 50 support staff, split between case managers, who help with admin and the preparation of mortgage proposals, and customer service staff who liaise with customers after deals are closed. Average annual salaries for support staff are £25k.

- The total cost per acquisition (CPA) for a new customer, including lead costs, advisor salaries and commission is £738, producing a gross margin after the cost of sales of 29%.

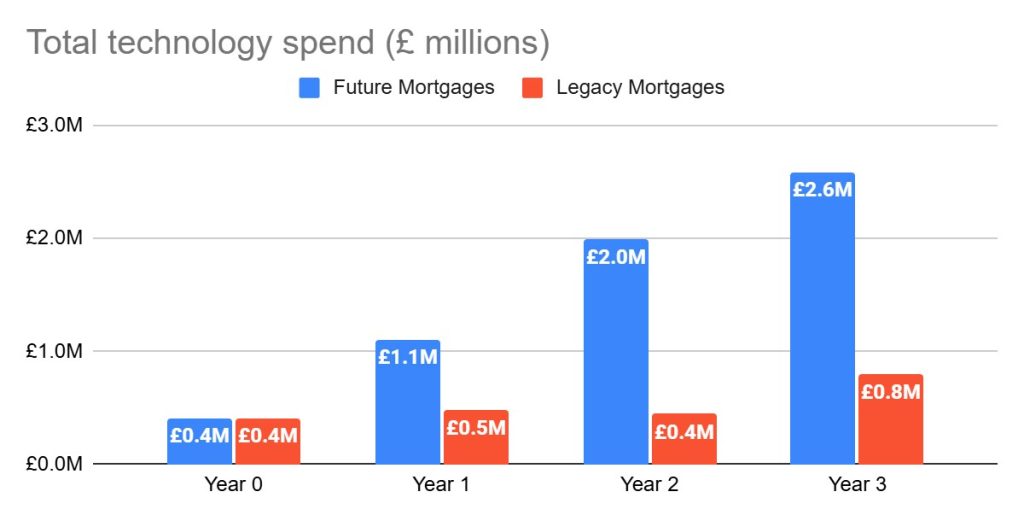

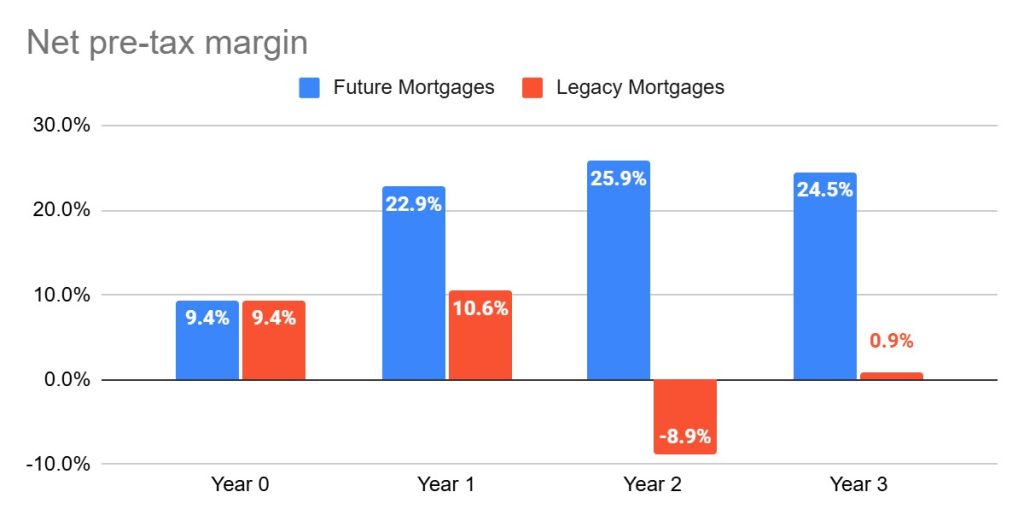

- The mortgage brokerage industry is competitive, so margins are tight, but reasonably predictable. Each company generates a net pre-tax margin of 9% after paying for support staff and other overheads. This includes a relatively modest annual technology budget of just over £400k – equivalent to roughly £200 per employee per month to cover the various SaaS tools they use and provide secure cloud connectivity for their hybrid workforce.

- The companies start 2025 with just under £3M cash in the bank, enough to cover six months of fixed overheads. Any after tax profit over-and-above this cash float is normally paid as a dividend to shareholders.

2025 – Year 1 of the AI Transition

Future Mortgages

From past experience, Sonny Nadella understands that the work of AI adoption will happen bottom-up; where the hands-on understanding of the many processes that constitute the operations of the enterprise reside. He also knows that the awakening of an AI-first culture must start at the top. He begins the year by working with the executive team to get everyone onboard and put the conditions in place to ramp up AI adoption. A number of initiatives are launched:

- Shareholders forgo their dividend from 2024’s operations to fund a tripling of technology spend, including:

- Hiring a new CTO who was leading AI adoption efforts at a smaller competitor of the SaaS company Sonny used to work at.

- Hiring a small dev team, handpicked by the new CTO to assist with AI integration and implementation support for the wider workforce.

- The CTO’s first job is to empower Future’s AI-first workforce by providing them with access to leading AI models and no-code / low-code agent builders through an enterprise AI platform that connects securely to all of Future’s company data.

- Staff are given training to understand current AI capabilities and challenged to identify opportunities where Replacement Level Intelligence (RLI) might be capable and economical enough to augment their roles.

- A framework is put in place to measure success and reward ‘AI Champions’ in each department to incentivise innovation.

- Sonny also liaises continuously one-on-one with department heads and staff to conduct his own analysis across functions within the company. This helps him steer the AI Transition and focus staff attention and technology investment on the lowest hanging fruit. Some insights emerge from this process:

- If Future could automate away the administrative and follow-up burden from its mortgage advisors, he could increase the number of leads each of them is able to work, thus increasing sales without increasing the number of advisors they employ.

- Analysing deal cycles across the 12K+ deals the company did in 2024, the data shows a strong correlation between how quickly they get mortgage proposals out to customers; and the close rate and share of deals that include mortgage insurance. The less time it takes to get a proposal to a prospective customer, the lower the lead cost per acquisition and the higher the average deal value.

- Speaking with advisors, Sonny realises that many of the so-called “exclusive” leads they buy aren’t actually exclusive after all, because buyers searching for mortgages often apply through more than one mortgage comparison website. This means being first in line to call new leads and improving follow-up on live deals could also increase close rates.

After a year of hard work and inspiring leadership, the Future team has implemented AI throughout many elements of its sales process and customer journey:

- Their archive of thousands of call recordings from deals closed by their top advisors is used to produce AI-generated call scripts for different customer scenarios.

- Instead of leads being assigned to advisors ahead of calls being made, new leads are now ingested directly from mortgage comparison website APIs, contacted immediately by call automation software and then routed to the next available advisor who is automatically shown optimal call scripts via their CRM based on the mortgage application data received with the lead. This makes it much more likely that Future gets in touch with new leads before competing brokers and levels up the performance of advisors with lower close rates by ensuring that best practice is followed on more calls.

- Calls with advisors are transcribed in real-time by AI and key details from the transcripts are extracted and fed into mortgage pricing platforms via APIs to automate the process of finding the best mortgage deal for each customer scenario. A mortgage proposal with legals and an email summary is then generated by the AI and passed automatically to case managers for a final ‘human-in-the-loop’ check (with call recordings and keyword markers attached for easy review). AI-generated proposal accuracy rates are about 95% (lower than the 98% human-only rate), so the human check is still needed prior to the proposals being sent out.

- A combination of AI and traditional rule-based software (the development of which is expedited by a factor of 2-3x by the AI coding assistants the dev team uses) is deployed to systemise prospect follow-up, including optimal scheduling and automatic generation of context-aware follow-up call scripts tailored to each mortgage application and deal stage.

- The most up-to-date customer service articles, prior responses from the top performing customer service reps, and live customer data are used by Future’s data-silo-agnostic AI platform to expedite, and increase the quality of, customer service responses.

A cascade of mutually reinforcing positive impacts occur:

- The deal admin process is reduced from an average of 2-3 hours per proposal to an average of 15 minutes and the communication burden between case managers and advisors is almost completely eliminated, freeing up time across the board.

- Case managers no longer spend the majority of their time preparing mortgage proposals, instead switching their focus to doing AI-assisted follow-up calls on behalf of the advisors.

- By the end of 2025, close rates and the share of customers who purchase mortgage insurance are up by 20% (an average of a 10% increase for the first year overall).

- Because of the time savings on admin, liaising with case managers and no longer having to do their own follow-up calls, advisors are now able to spend more of their time on initial consultations with new leads. By the end of the year they are able to increase the number of leads they work from 4 to 6 per day (with the company averaging 5 leads per day for 2025 as a whole). Average annual advisor compensation increases from a run rate of £56k to £66k – comfortably above the industry average.

- Customer service response times and workloads reduce by 70%, even with a human-in-the-loop check on most responses.

- Due to normal staff attrition, some support staff leave during the year and are not replaced. Future is now able to function with a 1 to 3 ratio of support staff to advisors and promote 10 of the more experienced team members into its advisor training and licensing program. These new advisors will be ramped up and ready to contribute to sales by Q1 of 2026.

Legacy Mortgages

Dave Collins meanwhile is doubling down on what’s always worked. More leads + more advisors = more sales!

- Legacy hires 20 new advisors. After years in the industry, Dave knows that good advisors close more leads and generate higher average deal values, so much of his focus in year one goes into recruiting experienced advisors and integrating them into the existing sales team.

- Legacy also expands its support team to maintain the tried and tested industry average of one support staff member to every two advisors.

- There’s no need for shareholders to waive any of their 2024 dividend to support Dave’s ambitious growth agenda. This is all very familiar territory for Dave who is a proven performer when it comes to growing and leading a sales-first organisation like Legacy. No doubt, the expansion will pay for itself.

Comparison of Financial Performance

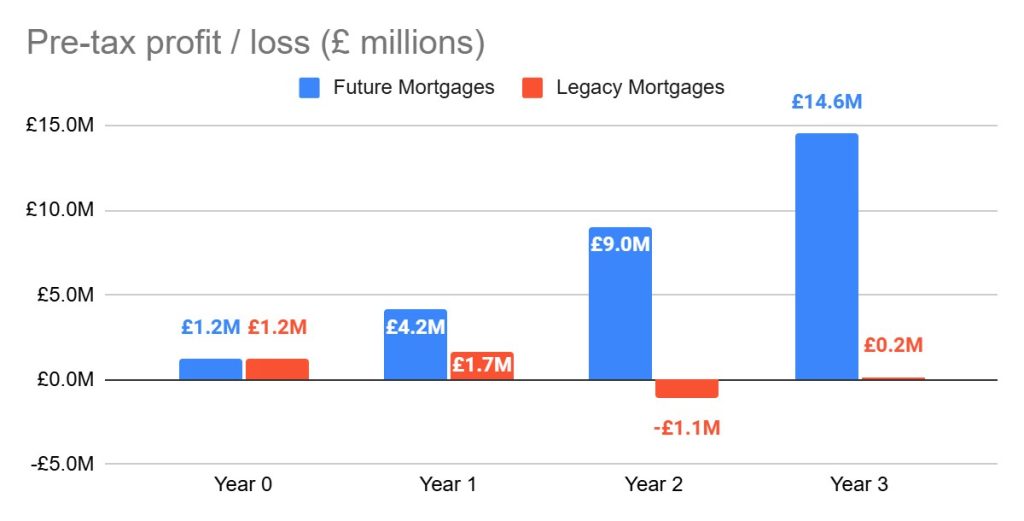

By year-end 2025, both companies’ shareholders are happy, but for different reasons.

At Future, morale is at an all-time high under Sonny’s leadership. Advisors are earning more than ever before and, with AI taking care of a lot of the repetitive tasks, everyone in the company is happier and more empowered in their work.

Future’s shareholders and management team keep having to pinch themselves. They’d been optimistic about the transformative potential of AI, especially given how suited it was to their particular business model, but the results are even better than they’d hoped for. A 39% increase in sales, a 13% reduction in cost per customer acquisition, gross margin up from 29% to 38% and, most importantly of all, net pre-tax margin has more than doubled from 9% to 23% (despite technology spending increasing from £400k to £1.1M). This puts an additional £3.1M cash in the bank after tax – more than triple their 2024 earnings. The shareholders take half of this as a dividend – their largest ever – and leave the rest in the company to invest further in the AI Transition!

Legacy’s sales are up by 20% – bang in line with the 20% increase in advisor and support staff headcount. Gross margins have held steady at 29% and pre-tax net margin has increased from 9.4% to 10.6%, resulting in a £1.25M dividend for shareholders – the largest they’ve ever taken. Nice to see those economies of scale starting to pay dividends. 2025 has been a ringing endorsement of Dave’s tenure as CEO. Time to double down on more growth!

2026 – Year 2 of the AI Transition

Future Mortgages

Confident in the AI-enabled improvement in the unit economics of the business, with £5.5M in the bank, the board throw their full support behind Sonny’s growth plans for 2026, with the following initiatives:

- AI investment continues with tech spend increasing from £600 to £800 per staff member per month. Some of the functions that weren’t quite ‘RLI-ready’ in 2025 are now ready for prime time. Improvements in model reliability and cost enable Future to economically deploy ‘verifier models’ into their agentic workflows, allowing them to take the human out of the loop in many of their existing AI-enabled processes. Major milestones hit in 2026 include:

- 80% of customer service enquiries are now handled completely autonomously by AI. This includes voice calls, many of which are now handled by AI voice agents. Consumers are starting to get used to AI and the majority of callers are happy to get immediate assistance from AI for basic enquiries, rather than waiting in a call queue for a human assistant.

- AI-generated mortgage proposal accuracy has now hit >98%; better than Future’s pre-AI human accuracy benchmark, so deal admin is now completely automated.

- AI voice agents are RLI-ready for deployment to make first contact with new leads and schedule calls for advisors doing initial consultations. When they’d tested this in 2025 the latency and reliability wasn’t quite there. Those performance issues are now in the rear-view mirror, and model costs are even lower than they were back in 2025 making it economically viable to deploy the frontier reasoning capabilities this requires.

- AI is now fully integrated with their outbound CRM (emails, text messaging and WhatsApp) and the digital elements of follow-up are now completely automated.

- Limited tests are run to use AI voice agents for initial consultation and follow-up calls. The AI voice model APIs are very impressive – noticeably better than they were in 2025 – but their capability still isn’t at the level of a good human advisor or case manager. Also, even though consumers are starting to get used to speaking with AI customer service bots, they aren’t quite ready to be called by a ‘robot advisor’. What’s more, the financial regulators are still playing catch-up. The law still requires a licensed human advisor to provide mortgage advice.

- Sonny decides it’s time to capitalise on their much improved unit economics, by amortising their tech development costs and squeezing the competition a bit:

- He implements an aggressive hiring campaign, specifically targeting high performing advisors from his competitors, including Legacy.

- He also takes a major decision to stop charging customers an arrangement fee. He figures that despite lower transaction values this will be net positive for Future because it’ll increase close rates even further while simultaneously making conditions more challenging for their competitors.

- The world is not standing still though. 2026 sees Future being subjected to some competitive pressures of its own:

- News of their success has travelled – the mortgage industry is a small world – and their CTO is headhunted by Big Nation Mortgages, the UK’s largest mortgage broker, to lead their AI transformation efforts. Fortunately, the foundations for Future’s AI-first culture and tech stack have already been laid. They promote their head of engineering to the CTO role.

- Competition for leads from Big Nation Mortgages other fast followers increases through 2026. This is set against a backdrop of a softening housing market driven by a global economic slowdown caused by the international trade war. With increasing demand and lower supply, lead costs increase from £30 to £35 per lead for the year.

Despite these minor setbacks, the result is an ongoing incremental improvement in all key KPIs and a further compounding of positive effects across the business:

- With all of the cumulative efficiencies, including customers receiving their proposals less than five minutes after the initial consultation call, optimally timed and scripted follow-up; and advisors having even more time to speak to fresh leads:

- Average close rates and the proportion of deals buying mortgage insurance increase by a further 10%.

- Advisors are now able to effectively work 7 leads per day on average.

- Despite no longer charging an arrangement fee, increased sales productivity means average total compensation for advisors is now £77k per annum; and total cost per customer acquisition is down another 15% (even with the increases lead costs).

- Future is now running at a ratio of one support worker to every four advisors, despite the increased deal volumes.

- In addition to the 10 new advisors promoted from the support team in 2025, thanks to the industry leading compensation rates it’s now paying, Future is able to headhunt an additional 30 of its competitors’ top advisors.

Legacy Mortgages

Dave’s plans for 2026 are simple: more of the same. What worked for years, worked in 2025 and the same will apply this year. The reality turns out somewhat differently.

The year sees a near-20% increase in lead prices – presumably because of a contraction in supply due to the softening mortgage market. Dave could live with that, but that’s not all he has to contend with:

- Future is becoming a real thorn in his side. They seem to be on a mission to steal his top advisors.

- On top of that, Future has stopped charging an arranging fee. Big Nation Mortgages soon followed suit, making them much tougher to compete with. Unfortunately, with the increasing lead costs, Legacy can’t afford to do the same, which leaves them between a rock and a hard place.

The result of all of this for Legacy’s KPIs are not at all good:

- Despite Legacy’s best efforts to hire more advisors, Dave’s average headcount for 2026 ends up going down from 120 to 110, and the average standard of the advisors he’s left with is also impacted.

- Close rates and the share of customers they’re able to sell mortgage insurance to drops by 10%.

- Because they’re forced to drop the arrangement fee on many of the deals where the buyer talks to their competition, they’re only able to charge the fee in a third, rather than half, of cases.

- As a result, their unit economics have taken a beating. Their average deal value is down by 8%, but their cost of customer acquisition is up by 11%.

Comparison of Financial Performance

The fortunes of our two companies are now looking very different.

Future’s revenue has nearly doubled from £18M to £35M. Gross margins have barely dropped from 38% to 37%, despite the rise in lead costs and the drop in average transaction values due to Sonny’s high-risk, high-leverage decision to drop the arrangement fee. Further economies of scale and ongoing increases in AI-enabled productivity have more than doubled earnings, leaving shareholders with a £6.8M profit after tax – more than 7x the profit the year before Sonny took the reins.

Legacy’s revenues are now back down to £12M from their 2025 high of £16M – even lower than the £13M before Dave’s tenure began, despite having 110 advisors. But that’s not the worst of it: the combination of higher lead costs, reduced close rates and lower average transaction values has taken gross margin down from 29% to 14%. The result is a net pre-tax loss of £1.1M – their first loss since the company’s early days when the global financial crisis nearly put them out of business.

2027 – Year 3 of the AI Transition

Given everything that’s happened, Legacy’s founder decides to return to the business. They still have some money in the bank, but that won’t last for long at the current rate. Fundamental change and a founder’s touch are required. As 2026 went from bad to worse, he’d started doing his own investigations – an ex-employee, now at Future, has told him what his competitor has been doing with AI. It looks like Dave’s, “I’d rather be a fast follower” mantra might have been the wrong call. Time to bite the bullet, increase tech spending and play AI catch-up.

Meanwhile, Future’s board and shareholders are debating what to do with the £12M+ they have in the bank: acquire a weaker competitor; pile more money into growth; or just issue a nice fat dividend? Decisions, decisions!

In 2027, lead costs continue to go up, with an increasing number of AI-enabled mortgage brokers able to pay more for leads. This is not a problem for Future as it continues to rack up compounding productivity gains from the AI Transition. With their advisors now averaging 8 leads a day and total compensation of nearly £90k, Future are on track to hit 200 advisors for the year as they continue hoovering up the best advisors from competitors.

Legacy manages to claw back some of the ground it lost 2026. Unfortunately, the ROI they achieve from increased technology spend isn’t as high as Future’s was when they got started because most of the gains have already been competed away by other AI-enabled competitors. Nevertheless, playing catch-up puts Legacy on target to scrape through with a small profit for 2027.

Late in the year, Legacy’s founder interviews a new manager for their support centre who has recently been made redundant by Future. She tells him that Future has just started a trial deployment of fully ‘robotic advisors’ under the Financial Conduct Authority’s new regulatory regime for ‘approved AI agents’. That same week, he receives a call out of the blue from Sonny Nadella with an offer to acquire Legacy for 5% of Future’s stock.

Sonny’s pitch? Now that the AI cat is fully out of the bag, major players like Big Nation Mortgages are positioned to build a dangerous scale advantage against smaller companies like them. The only way they can compete is to join forces. He’s forced to agree: Legacy’s left it too late to go it alone. A merged Future-Legacy would have all of the benefits of Future’s tech stack and they could cut back on management and staffing ratios by laying off most of Legacy’s management and support teams.

Future’s pre-tax profits for the year are projected to be £11M with a 25% margin. They could probably get 10x on that – valuing them at £110M if they sold to Big Nation who are in-market paying those sorts of prices. Legacy would struggle to get that multiple on its projected £170k profit, valuing it at £1.7M at best. 5% of the merged Future-Legacy entity would be worth about £6M. Going from 1:1 valuation with Future to 20:1 in three short years is a very bitter pill to swallow for Legacy’s Founder, but at least it’s a bird in the hand.

Conclusion

The key takeaway from this story is that incremental adoption of RLI for different functions affects productivity, cost structure and unit economics in relatively small ways year-over-year, but these gains have a compounding positive impact on a company’s competitiveness and financial results over consecutive years. The contrary is true for slow followers.

If you are in a competitive industry with constrained demand and relatively tight margins, being on the wrong side of this equation could threaten your survival more quickly than you might expect.

Gen-AI adoption calculation

- The total value of all labour in the world is ~$55 trillion. This figure is based on labour accounting for a 52% share of nominal global GDP, which was $106 trillion in 2023.

- The total value of knowledge work globally is >$14 trillion. This figure assumes a quarter of the global labour market value. Knowledge workers account for somewhere between 20% to 30% of the global workforce and are paid more, so $14T is likely very conservative.

- Global spend on generative AI usage – as in actual spending on the output of LLMs and other forms of gen-AI – is likely to be less than $50 billion. Again, it’s difficult to find data that measures just this component of “global gen-AI market value” reliably, but OpenAI is reported to have had revenues of $4 billion in 2024 and Anthropic’s annualised revenue at the end of 2024 (meaning annual revenue based on monthly recurring revenue in December presumably) was reported to be $1 billion. If we assume they only account for 10% of total global spend on gen-AI usage, we get to the $50 billion figure. They probably account for a larger share of gen-AI usage as the two most used frontier models, so $50B is likely an overestimate.

- Therefore, total gen-AI usage spend as a share of the market value of global knowledge work is less than 1% ($50B divided by $14T = 0.36%).

- Admittedly, as a method of assessing gen-AI adoption, this is a very rough guestimate. It could be argued that the actual figure is lower than 0.36% given that both the numerator and denominator are weighted in favour of higher adoption. On the other hand, it could be argued that the figure is actually higher because $1 of gen-AI “labour” is not one-for-one equivalent to $1 of human labour, since gen-AI is only likely to be implemented at scale when it is cheaper per unit of output than the human labour it replaces.